We sold our first home 5 years ago. Since then I have lived with rental anxiety for fear of having a rental contract terminated and being stuck for somewhere to live with my two children and most importantly… My dog. Landlords aren’t generally fans of dogs in my experience. It can be very much a case of taking what you can get when you need to house your furry friend too.

After relocating 3 years ago and renting the same lovely house we’re taking the plunge and trying to buy a house. It’s been almost 12 years since we last bought and I had completely forgotten the process so I thought I’d put together a bit of a guide for how to buy a house in case you find yourself in a similar position.

How To Buy A House In The UK

There is a massive culture in the UK that owning a property is ‘best’. That’s not always the case. Don’t be pressured into a buying a property if it isn’t right for you at that time – you need to think about the future and the investment you’re making and if it is right for you regardless of others opinions.

From a recent Instagram poll we ran, 13% of you are currently renting. I have rented my current house for 3 years and that has been the right thing for us. Yes we’ve spent money paying off someone else’s mortgage but we know in the grand scheme of things it would be for a short term and it has allowed us to get to know the area we live in, create an amazing community of friends and more importantly it has given us time to make decisions about our future and what is the right thing for us. And now the next step for us is to buy. We have started the process of buying a new build. I’m going to try and cover off all aspects of buying existing and new builds but as always please do let me know in the comments below if there is anything I need to add in from your experiences.

First Steps When Buying A House

Check your credit score. I believe there are three main credit reference agencies that lenders use including Experian. When applying for a mortgage your lender will run a full credit check so it’s good to know what your score is and if you’re unsure of what it all means you can call Experian (or your chosen credit reference agency) and they will run through it all with you and give you tips on how to improve your score should you need to. There are specialist mortgage lenders out there that will cater for people with adverse credit so just because you might have a low score doesn’t necessarily mean you can’t get a mortgage – it is just likely that you will pay a higher rate of interest.

So credit score checked, the next move is to calculate how much you can borrow. You can use a mortgage calculator which you will be able to find on most mortgage lender websites and you can also look at a mortgage deposit calculator. You can also check their lending criteria whilst there as well. Check savings and see if you have enough in place for the deposit that you would require. Lenders also accept gifting for deposits if anyone wants to contribute to your deposit.

Perhaps one of the best pieces of advice to take at this point is don’t max yourself out. Just because you have seen how much a mortgage provider will lend you doesn’t mean that you have to take that amount. What you can lend and what you can actually afford can be two different things. The last thing you want is to have bought a house you love and not be able to keep up payments on it. Also be aware that for you, it is a huge undertaking but for your estate agents and solicitors it’s their every day job. You’re not the only one buying a house so you will find that you’ll likely have to chase for things.

What Is Help To Buy

When it comes to buying a new build you could be eligible for the governments Help To Buy scheme. If buying straight out it’s likely you will have to find a minimum of 10% of the property value for your deposit but with HTB you only need to find 5%. The government then contributes 20% so in total you are lending 75% of the value of the property. In brief, you pay 0% interest on that 20% investment from the government for the first 5 years, following that you start to pay interest only on it. You can either pay that 20% back in half or full at any point during ownership or upon sale of the property. You will pay 20% of whatever the value of the property is at point of sale/pay back – so if your property has increased in value you pay more back or if the value has dropped you pay less.

You can read more about Help To Buy here.

Benefits For First Time Buyers

If you are a first time buyer and aged between 18 and 39 you may be entitled to get up to £32,000 of funding through the government if you open a new Lifetime ISA. You may recall this launching in 2017. Essentially you can save up to £4,000 a year (by depositing a lump sum or by saving as and when). The government will then add a 25% bonus on top fof that if you use the funds to purchase your first home. So for example – if you save £4,000 your total will actually be £5,000 and that’s before any interest has accrued too.

How Much Does It Cost To Buy A House

So you’ve done all your research into lending and deposits and you’ve started house hunting (I’ll go more in to that shortly) but how much does it really cost to buy a house?

Here is around up of fees you should consider:

• If you’re using a mortgage advisor you may have fees for them – these are often absorbed by lenders but always check with your advisor upfront.

• Valuation fee – You pay this to your mortgage lender upfront and it can be between £200 – £500.

• Arrangement fee – This is to set up your mortgage and is typically about £1000. It can be added on to your loan if you choose.

• Legal/solicitors fees – Your fees are made up of several factors including your stamp duty fee, mortgage application review, local search fees, land registry fee, possibly a fee for processing a gifted deposit if that applies to you and identity search fees. Legal fees typically come in somewhere between £850 – £1000.

• Surveys (where they are looking for subsidence/damp/structural issues etc) – these can come in anywhere between £300 – £700 and depending on the type of house you’re buying you might need more than one.

• Your mortgage company is likely to charge you a telegraphic transfer fee of around £25.

• Removal fees – If you’re looking to hire a decent sized van and move yourself you could be looking to spend about £60+ a day or for a professional move, possibly where the movers pack your stuff and dismantle and rebuild furniture you could be looking at upwards of £700 depending on how much you have to move.

• Furnishing – If you’re moving into your first home or even a new one where existing fixtures/fittings/furniture doesn’t fit you will need to kit it out so allow budget for furnishings as well.

• Home repairs – if after viewing you know there is work that will be required at the property try and get quotes for all of these jobs before committing so you can make sure at least the most urgent jobs can be accommodated in to your budget.

With all these costs it’s really important to make sure you have some savings to see you comfortably through the ew months before, during and after sorting your house purchase. You are asked to shell out £400 for a valuation here and £300 for searches there your funds may soon deplete so make sure you have enough to see the full process through.

How Much Is Stamp Duty

If you’re a first time buyer you will be exempt from paying stamp duty on properties up to a value of £300,000. (You can find out more about stamp duty relief here). If you’re not a first time buyer you will pay stamp duty on properties with a purchase prince of £125,000 or more. Our stamp duty is being dealt with by our Solicitor so I presume that is the norm. You don’t need to do anything separately for it.

You can find a stamp duty calculator here to work out how much yours would be.

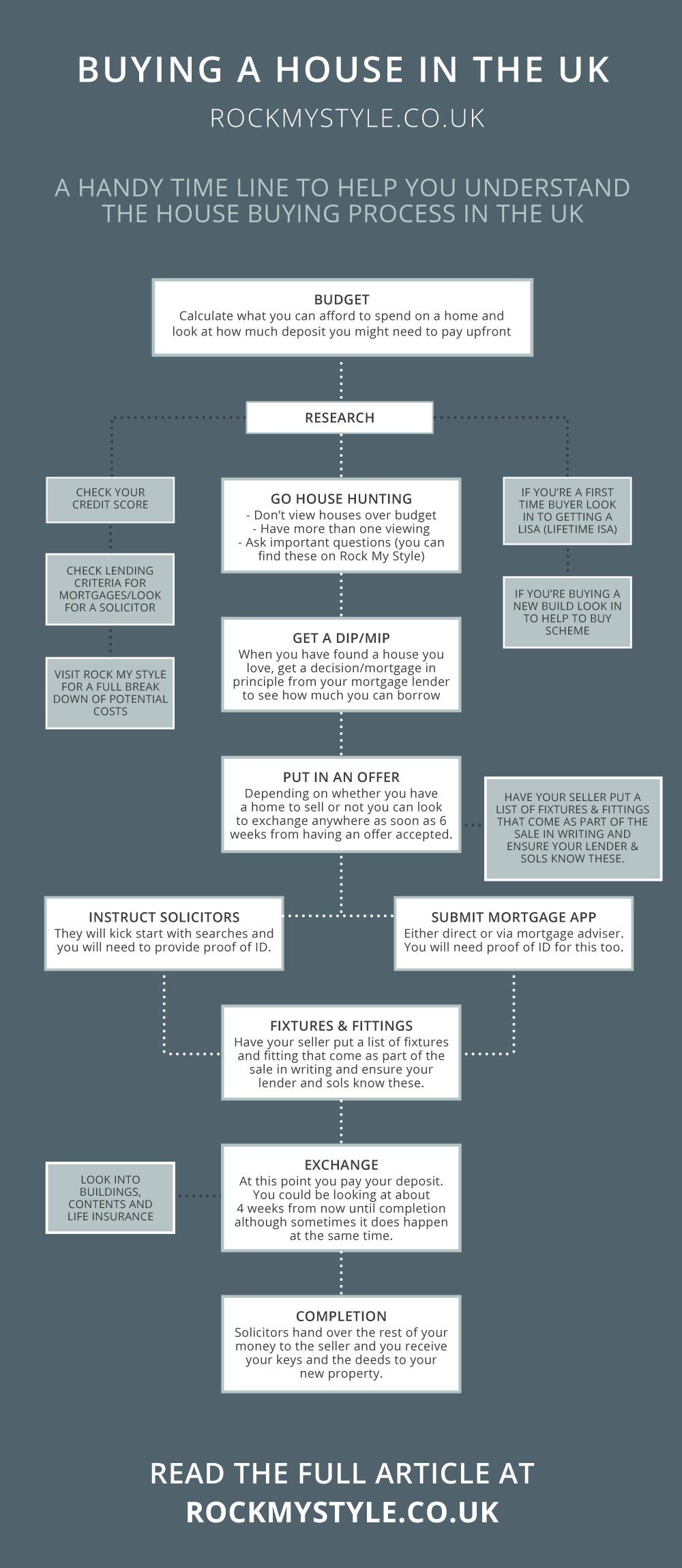

I have made this handy Buying A House timeline that you can pin to remind yourself of the steps involved. It includes asking questions when you go to view houses that you really like… You can see what we think are ten really important ones to ask here.

{PIN THE TIME LINE}

I hope if you’re thinking of buying sometime soon that this has been helpful and as always I’m sure our wonderful community will pitch in below with anything I might have missed or any great tips to consider when buying a home. If you want to know more about the exchange period and how long that might take you can read Lauren’s really helpful post here. There is tonnes of reader insight to read through too.

Find out what the council tax for the house is – ours has just gone up and we have to fork out 260 a month.

That’s a great point Siobhan!

Ours has gone up by 4% this year, I imagine lots of places have similar rises. Also, on a separate topic, what happens about surveys/snagging etc on new builds? How does it work? xx

Surveys have been left to our solicitors – they have been extremely straightforward with everything and we haven’t requested any additional surveys. From the top of my head I believe we get three weeks to compile our snag list but also have a period of time post completion and snags that we can continue to report issues/any other snags that have appeared. And we have a ten year building warranty as well. x

Great post Becky! My advice would be to look at the terms of the mortgage very carefully. How much does it cost to switch your deal if you want to before the end of the term? And can you make overpayments? You might not be in a position to even consider either of these now but it is good to know everything just in case your circumstances change. If it is a tracker rate make sure you can make the increased payments if the base rate goes up, or for fixed rate mortgages make sure you know what rate it will revert to at the end of the fixing period. Good luck with the new house Becky! How long until you get to move in? Sounds exciting. x

Really good advice Annie, thank you for sharing. And thank you for your well wishes… I’m trying not to think about it too much as I’m aware things can always go wring during the process but we;re hoping to complete next week! We won’t be moving until mid April though… x

Get recommendations for good solicitors. I moved into a new house four months ago and received appalling service from a very well known local firm and I am still chasing them now to send the land registry form and change of ownership of the solar panels on the house. I later learnt my solicitor was well known amongst agents for poor service.

View ALL the houses! Even houses that look the same on the outside are often so different inside. You may surprise yourself at what you find yourself drawn to. I had nearly counted out the area I live in as the two houses I viewed there had tiny gardens, but my hubby convinced me to see a third that didn’t have as much curb appeal and it was the one we bought – it has a good sized garden and stunning views which were not featured in the agents photos.

If you are considering putting in an offer visit the house at different times of the day (even if just driving past and parking up on the street for a few minutes) to check out things such as how busy the road is or whether there are parking problems in the evenings etc. I nearly fell for a lovely cottage but the road turned out to be busier than expected and the neighbour had four dogs (I have a dog myself but four large dogs barking in the garden next door was a deal breaker).

If budget allows use a good removal firm. I paid just under £700 but they were amazing! They took down large pieces of furniture, put them together again and put everything exactly where we wanted it, provided garment hanging boxes, took down artwork and packaged it up safely, and made the moving day a less stressful. It was money well spent.

Thanks for sharing your experience Claire! Sorry you’re still having to chase for things! And such solid advice for how to find the right house. So helpful. We’re jsut debating whether to get a removal team or do it ourselves… we’re not moving far and I’m hoping I can kind of do it in dribs and drabs as we have a few weeks from completion to when we want to actually move in x

I hope it all goes smoothly. Moving house is so exciting!

Thank you so much! I am so nervous about the whole thing. Really looking forward to having those keys in my hands so I can relax a bit.x

I bought a new build as a first tiem buyre so it was ncie and straightforward. I am now planning to sell that in the next few months and buy with my partner. I’m still a bit unsure of what to do first, do i have to wait till mine is sold before I can offer? Also finding it difficult to get a rough idea of selling fees vs buying costs.

Hi Bunny, I sold and bought at the same time last year. We couldn’t have our offer accepted on the house we wanted to buy until we already had an offer on our own house.

Selling fees are roughly:

Remortgaging £1500

Estate agent fee 1% – 1.5% of sold price

Conveyancing £1500+ depending on number of searches and surveys

(plus buying costs)

EPC £100

Hope this helps x

Thanks Claire B. Do I have to get an EPC or can I use the one I must have as my house is only 2 years old? I want to cover the selling fees myself, as the house is mine, and then share the buying fees with my other half as we’re buying together. So I guess we’ll split any mortgage fee. I guess the conveyancing is for the buying bit?

Not sure about EPC but I wouldn’t have thought anything would change in 2 years. Conveyancing is the selling and buying legal processes – there will be separate costs for each. Hope it all goes well x

This article is so useful! I actually forwarded it to my normally blog cynical boyfriend, and he loved it. Thank you for writing it. I am in the starting process of buying my first house with my other half. We are moving from rented back into our respective relatives to save, but this post has answered a lot of questions about all the different steps, that the mortgage advisors just didn’t seem to be that helpful on. Particularly the how much it cost part!

Just out of interest, how did you/ others handle the saving for a deposit(or any large financial event e.g wedding etc (not engaged-asking for a friend there) / restrictions on date activities? I know you were living together so it’s very different, but we are going from living together, to back to separate? Is there a secret list of cheap date ideas I/ we don’t know about?? Thanks x

Hi Amelia, hubby and I saved 25% deposit for our house – the interest rates were better at this percent making our mortgage £100 a month cheaper. We didn’t need to put down big deposits for our wedding, maybe because we got married on Friday 13th 😂 We only spent what we could save in a year on our wedding

So glad you found it helpful! I’d definitely look into a LISA to help you start saving. Maybe there is a postbin cheap date nights that we need to put together for you! I remember when we were trying to save for our first house we literally just used to watch box sets and eat spaghetti Bolognaise every night! Good luck with saving and buying. How exciting!